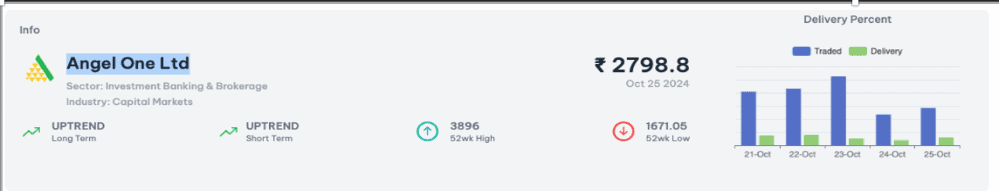

Angel One Ltd is exhibiting a strong upward trend in both the short and long term, indicating a positive market outlook

Overview of Angel One Ltd

- Long-term Trend: Up

- Angel One has shown a consistent long-term growth trajectory, reflecting solid business fundamentals and strategic initiatives that have positioned the company favorably within the financial services sector. This trend suggests sustained investor confidence and potential for continued expansion.

- Short-term Trend: Up

- In the short term, Angel One’s stock has been experiencing upward momentum, likely driven by recent developments such as increased trading volumes, successful product launches, or favorable market conditions. This momentum indicates the company is well-aligned with current market dynamics.

- Noticeable Demand

- There is a significant increase in demand for Angel One’s services, possibly due to growing interest in retail trading and investments, particularly among new investors. This demand can be attributed to the company’s user-friendly platforms and innovative offerings, enhancing its appeal in the competitive fintech landscape.

- Out-performing Benchmark in Coming Quarters

- Angel One is expected to outpace major benchmarks in the upcoming quarters. This potential outperformance may be driven by its strategic initiatives, market share growth, and the overall bullish sentiment in the financial services sector. Positive quarterly results could further reinforce this trend.

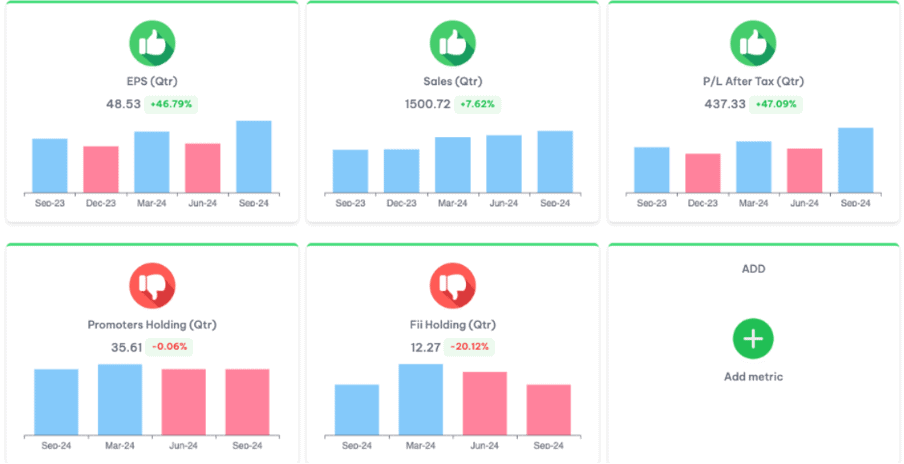

Fundamental Strengths of Angel One Ltd

- Return on Equity (ROE)

- Angel One boasts an impressive average ROE of 40.31%, indicating highly efficient management and strong profitability. This high ROE reflects the company’s ability to generate substantial returns for its shareholders, which is a positive sign for investors.

- Healthy Long-term Growth

- The company has exhibited robust growth in net sales, with an annual growth rate of 55.20%. This significant increase demonstrates strong demand for its services and effective market penetration.

- Operating profit growth is even more remarkable, recorded at 84.31%. This suggests that Angel One is not only increasing its sales but also improving its operational efficiency, which enhances overall profitability.

- Improving Quarterly Results

- Angel One reported a 44.63% growth in net profit for Q2 FY24, showcasing its ability to enhance profitability on a quarterly basis. Such positive results are indicative of strong operational performance and effective cost management.

- The company declared its highest net sales for the quarter at Rs 1,514.71 crore, highlighting its increasing market share and demand for its offerings.

- Operating Profit to Net Sales

- The operating profit margin reached its highest level at 44.35%, demonstrating the company’s strong pricing power and efficient cost structure. A high operating margin indicates that Angel One is successfully converting a significant portion of its sales into profits, which is crucial for sustainable growth.

Technical Analysis of Angel One : A Bullish Outlook

Angel One Ltd is showing promising technical indication, positioning it as a strong candidate for investors. The stock is currently on an upward trajectory, characterized by key patterns and metrics that suggest continued growth.

Bullish Patterns: Higher Lows and Higher Highs

One of the most compelling features of Angel one’s price action is its formation of higher lows and higher highs. This consistent upward movement reflects increasing investor confidence and buying pressure. Such patterns are indicative of a robust uptrend, suggesting that the stock has the potential to continue its ascent.

Trading Above Key Moving Averages

Angel one is trading above its key moving averages, including the Long-terms and Short-term moving averages. This is a critical technical signal; when a stock trades above these averages, it indicates strong bullish momentum. These moving averages often serve as dynamic support levels, and remaining above them reinforces the positive sentiment surrounding the stock.

Volume Trends

Volume plays a critical role in confirming price movements. Angel One has been experiencing increased delivery volume alongside price increases, indicating robust investor interest. Higher volume during price advances suggests conviction in the uptrend, further solidifying the stock’s bullish outlook.

Supply Vs Demands

· 6-Month Demand vs. Supply (1.98x):

- This indicates that demand is still higher than supply, but the ratio suggests a more stable market condition. The lower ratio compared to shorter terms may indicate a gradual normalization or a slowing growth trend.

· 3-Month Demand vs. Supply (3.16x):

- A stronger demand compared to the 6-month trend, suggesting a recent increase in interest or need for the company’s services/products. This could be due to seasonal factors or recent developments in the company or industry.

· 1-Month Demand vs. Supply (5.46x): This high ratio indicates a significant spike in demand compared to supply, suggesting that in the short term, there’s strong investor interest or market conditions favouring the company.

No responses yet